Mar 31, 21 · IRS tax deadline Retirement and health contributions extended to May 17, but estimated payments still due April 15 The legislation allows taxpayers who earned less than $150,000 in adjustedApr 01, · Ah, I see that you're reading the descriptionOriginal https//youtube/yrYZwuevnasThis is a true masterpieceJun 18, 21 · Don't Overshare Only send what is asked for Don't overshare with the IRS but at the same time don't send a riddle If you make the processing agent's job a little bit easier, they might make your life a little bit easier When they ask for your favorite color, don't

/child-and-dependent-care-tax-credit-3193008-v22-0582476abda64d80babcb8f67b52d734.png)

Can You Claim A Child And Dependent Care Tax Credit

I don't care who the irs sends i'm not paying taxes

I don't care who the irs sends i'm not paying taxes-I don't care who the IRS sends, I am not paying taxes If playback doesn't begin shortly, try restarting your device Videos you watch may be added to the TV's watch history and influence TV recommendations To avoid this, cancel and sign in to on your computerMay 25, 21 · The IRS don't care about use Reply Keith says Thursday at 1238 am Got a letter from IRS 3/11/21 saying I needed to send my 1095A form and fill out the 62 form Because I didn't initially filed it when I efiled I didn't have to amend Faxed all paperwork needed the next day 3/12/21z Finally got approved today and will get my

I Dont Care Who The Irs Sends I Am Not Paying Taxes Youtube

Four Things You Should Know Before Calling the IRS If you're one of the millions of people who need to call the IRS every year, here's the IRS phone number – and what you need to know before calling Individuals (800) Businesses (800) TTY/TDD for people with hearing impairments (800)About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us CreatorsFeb 26, 21 · The 05% penalty on her $100 payment would have amounted to $050 Anything under a dollar, the IRS is generous enough to let go In cases with more substantial underpayments, the IRS can issue a

If it's just called in probably nothing If it's through the wistleblower program then they would have to fill out a form and send it in Once the form is sent in it will be reviewed to make sure that it's not frivolous If it moves up then you woApr 15, 21 · All first and second Economic Impact Payments have been sent Check your final payment status in Get My Payment If you didn't get any payments or got less than the full amounts, you may qualify for the Recovery Rebate Credit and must file a tax return to claim the credit even if you don't normally file See Recovery Rebate Credit forAnother fake IRS letter that has been circulated is similar to this "Attention taxpayer You owe $2,000 in taxes to the IRS If you don't pay this amount immediately, you may be subject to tax penalties or imprisonment Please make payment to the address below We

Oct 14, · If you no longer have access to a copy of the check, call the IRS tollfree at (individual) or (business) (see telephone and local assistance for hours of operation) and explain to the assistor that youMay 03, 21 · The most effective way to get in touch with IRS personnel by mail is to contact the director for your local IRS district or your local Taxpayer Assistance Center You should allow at least 30 days for a response Many responses can take 45 days or longer 5He's not paying taxes tho#meme #iamnotpayingtaxes #shitpoststatus

What The Mail Backlog At The Irs Means For You The Wolf Group

I Don T Care Who The Irs Sends I Am Not Paying Taxes Youtube

I don't care who the IRS sends Absolutely no memes or memetic content Absolutely no political content or political figures, regardless of context or focus Absolutely no social media screenshots, videos, or other such content A complete breakdown of our rules can be found hereJun 04, 21 · The IRS will send a separate notice to you if your refund is offset to pay any unpaid debts Child Care Credit Expanded for 21 (Up to $8,000 Available!) Don'tJul 07, · However, if the IRS overpays you don't start making plans to take an extra vacation, buy a new car or give your savings account an extra boost Instead be prepared to give it back Sometimes, the IRS does find mistakes in your calculations or entries and it will send you a bigger refund than you were expecting

I Don T Care Who The Irs Sends Funny

What To Do If The Irs Sends An Audit Notice Military Com

IRS does not control the Time a refund is deposited, only the Day — the Time is based on the policy of the depositing bank IRS uses the Automated Clearing House (ACH) to send refund deposits to the banks, how they process it determines the time wI Just Don't Care About the Excuses Anymore I just Need My Refund Sent amended form with a check in March, $3000 checks got deposited by the IRS, but still getting no update at all for my $4000 refund that they supposed to send me questions and wellreasoned answers for maintaining compliance with the Internal Revenue Service, IRSMay 26, 21 · The IRS has sent more than 169 million stimulus payments since the passage of the American Rescue Plan Act But even with this many distributed, you might be checking Get My Payment and seeing a

Sotheanut Chiv

Sonya Ice I Don T Care Who The Irs Sends I M Not Paying Taxes

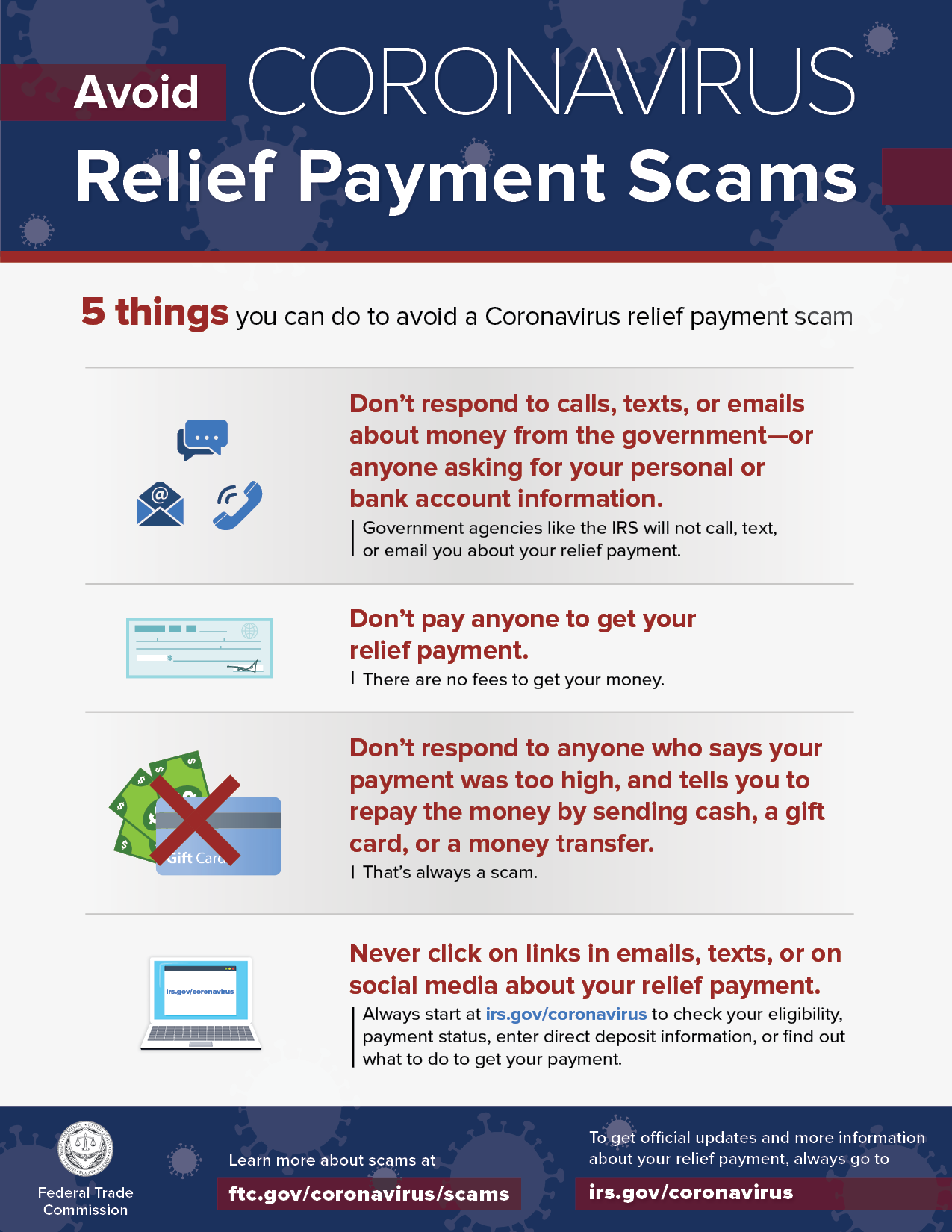

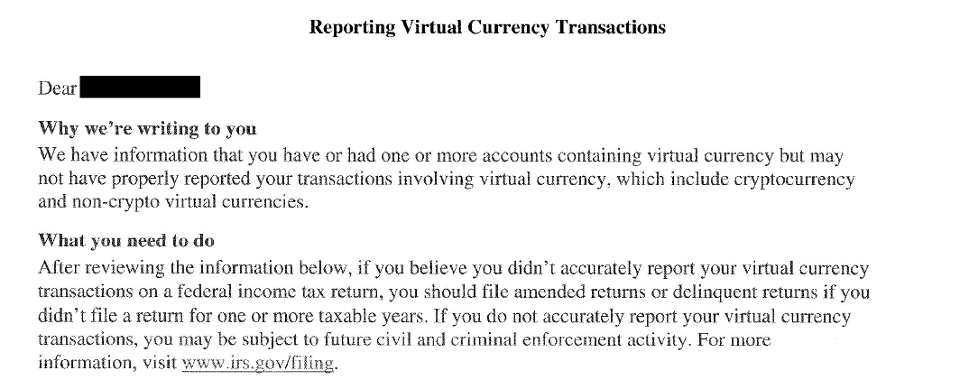

Mar 30, 21 · Don't Don't reply to or click on any links in suspicious emails, texts, and social media messages Make sure to report anything suspicious to the IRS Tax Transcript Email Scam Scammers claiming to be from "IRS Online" are sending fraudulent email messages about tax transcripts A transcript is a summary of your tax returnYou paid your taxes—but now the IRS says that you owe more Each year, the IRS sends out millions of notices requesting additional payments from taxpayers who made math errors on their returnsneglected to report certain incomeclaimed tax credits or deductions that they were not entitled toor made other mistakesMar 15, 21 · Call us at (tollfree) and either use the automated system or speak with an agent However, if you filed a married filing jointly return, you can't initiate a trace using the automated systems Download and complete the Form 3911, Taxpayer Statement Regarding Refund PDF or the IRS can send you a Form 3911 to get the replacement

Summary Of Eitc Letters Notices H R Block

Steps To Help Prepare For An Irs Audit Audit Notice Tax Audit Letter

Jun 22, 21 · People have lots of questions about the $3,000 or $3,600 child tax credit and the advance payments that the IRS will send to most families in 21 – and we have answers by Joy Taylor June 22, 21= # images Q & Ob NEW MeSSAGES MalarMax d "I don't care who the IRS sends I'm not paying taxes" shiloh dynasty i dy 2 videoOmov (105 MB) Message # magMar 15, 21 · To get a copy of your IRS notice or letter in Braille or large print, visit the Information About the Alternative Media Center page for more details Why was I notified by the IRS?

Irs Adding Qr Codes To Tax Due Notices Don T Mess With Taxes

Getting Stimulus Payments To Homeless Communities Ftc Consumer Information

The IRS sends notices and letters for the following reasons You have a balance due You are due a larger or smaller refund We have a question about your tax returnAug , · As the IRS gets caught up on a large backlog of mail, taxpayers who mailed in checks months ago are now receiving notices from the taxman, indicating they still owe Don't panic Here's what youJun 07, 21 · The IRS has identified over 36 million families that may qualify for monthly child tax credit payments of up to $300 per child The payments will begin on July 15

I Dont Care Who The Irs Sends I Am Not Paying Taxes Youtube

It S Saturday So I Can Post This Now F Mods R Politicalcompassmemes Political Compass Know Your Meme

Apr 27, 21 · If you received a letter from the IRS about the Earned Income Tax Credit (EITC), also called EIC, the Child Tax Credit/Additional Child Tax Credit (CTC/ACTC) or the American Opportunity Tax Credit (AOTC), don't ignore the letter (notice) Follow the directions on your letter All the information you need is in your letterMar 31, 21 · IR2171, March 31, 21 — To help taxpayers, the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue PlanSooner or later the IRS will send you a letter detailing why they sent you an amount different from the one you were expecting Don't ask me why they don't send the letter with the check (This is just a demonstration of the genius behind the IRS and something they alone can understand) In the letter, they'll try to explain the reason

When Will The Irs Send The Third Stimulus Checks

Not Even A Supermodel Would Change His Mind 9gag

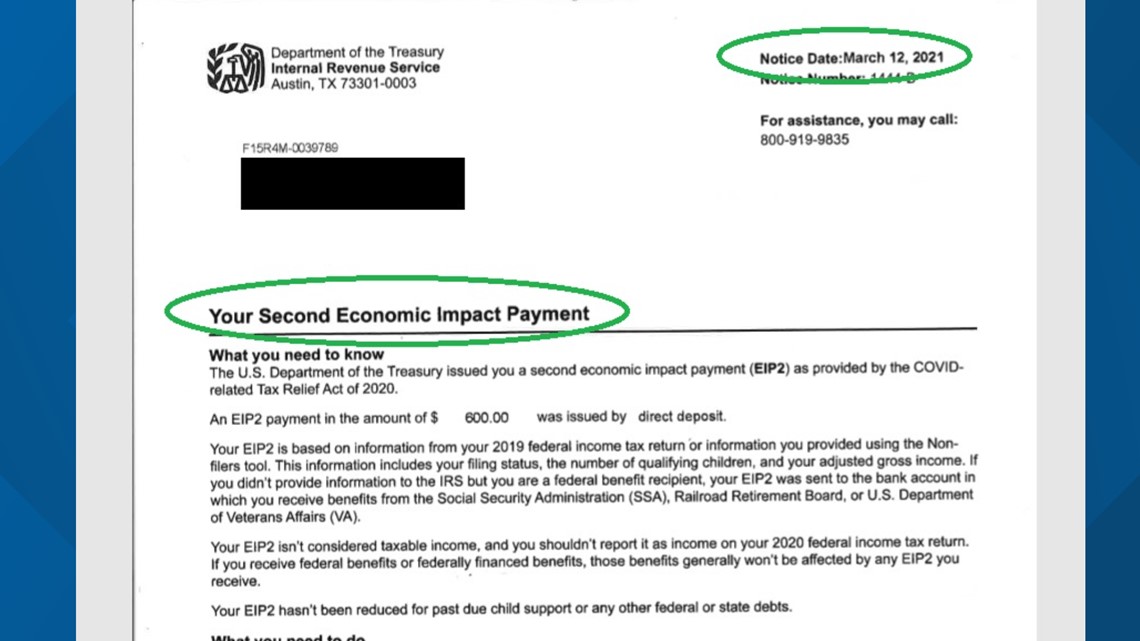

May 27, 21 · With the two first stimulus payments, the IRS also sent a confirmation letter in the mail within 15 days of your payment going out Notices 1444A and 1444B If you don't have the IRSApr 28, 21 · Credits to skitkat#5458 @ Discord for this vid/art/anim thing yesYou basically need to be in the Discord server to understand the context to this video lolDiJun 10, 21 · Fire the IRS Chief Who Doesn't Care if the Rich Don't Pay I'm already a fan, don't show this again Send MSN Feedback

The Wolf Man Transcript Dan Vs Wiki Fandom

Ewerton Santos

Mar 23, 21 · The Form 1095B is an Internal Revenue Service (IRS) document that many, but not all, people who have MediCal will receive The Department of Health Care Services (DHCS) only sends Form 1095B to people who had MediCal benefits that met certain requirements, known as "minimum essential coverage (MEC)," at least one month during the tax yearAug 18, · The IRS says 139 million taxpayers will get a check averaging $18 on the interest on their refunds Normally, the IRS pays interest only on refunds paid after 45 days from the date the return is filed, if returns are filed by the tax deadline But if you file late because the IRS has extended the filing deadline because of a disaster, the IRSApr 22, 21 · The income cutoff to receive a third stimulus check is $80,000 for an individual taxpayer, $1,000 for a head of household and $160,000 for a married couple that files jointly If you make more

Vyaauѕsh

Safe Artist Pony Berserker Derpibooru Import Trixie Twilight Sparkle Oc Oc Berzie Alicorn Changeling Kingdom Image Monochrome Png Pony Berserker S Twitter Sketches Speech Bubble Stippling Taxes Twilight Sparkle Alicorn

I Don T Care Who The Irs Sends I M Not Paying Taxes Youtube

P A Y T A X E S President ron Kimball Newvegasmemes

Jarlc Dude I Don T Care Who The Irs Sends I Am Not Paying Taxes

Futbolr21

Watch Mail For Debit Card Stimulus Payment

Irs Notice Cp515 Tax Return Not Filed H R Block

Irs Third Round Of Economic Impact Payments Going Out Vantage Point

Image ged In I Dont Care Who The Irs Sends Im Not Gonna Pay My Taxes Imgflip

How To Contact The Irs If You Haven T Received Your Refund

I W9ljaqne0zrm

Stop Falling For This Phone Scam About Your Social Security Newscentermaine Com

What To Do If You Receive An Irs Notice Cp2100 Or Cp2100a

I Don T Care Who The Irs Sends I Am Not Paying My Taxes Youtube

Coronavirus Stimulus Checks 80m Still Waiting For Irs Payment Why The Holdup Abc7 San Francisco

Third Stimulus Check Who Is Getting Extra Money Why And How Much As Com

The Wolf Man Episode Dan Vs Wiki Fandom

Still Waiting On The Irs Nation And World Nny360 Com

Stimulus Update Irs Sends Out Next Batch Of Stimulus Checks Action News Jax

Congress Wants To Send Americans Money Turns Out It S Complicated Politico

It Can Be Super Super Easy Or It Can Be Insanely Complicated Need To Report Bitcoin Trades To The Irs Read This First Marketwatch

What To Do If You Receive A Notice Or Letter From The Irs

I Don T Care Who The Irs Sends I Am Not Paying Taxes Youtube

Where S My Third Stimulus Check The Turbotax Blog

/child-and-dependent-care-tax-credit-3193008-v22-0582476abda64d80babcb8f67b52d734.png)

Can You Claim A Child And Dependent Care Tax Credit

Should You Pay A B Notice Fine Or Argue For Abatement

Nine Love Letters From The I R S Tpl

3b7yglplb4rz3m

Us Stimulus Checks News Summary For 10 April As Com

Irs Raises 21 Employer Health Plan Affordability Threshold To 9 Of Pay

Your Quick Guide To Irs Notices Canopy

Bubbla Arts I Don T Care Who The Irs Sends I Am Not Paying Taxes Danvs Handbanana Drawing Art

Stimulus Checks Irs Sends Out Another 37 Million Payments

Irs Sends Stimulus Checks To Dead Colorado Taxpayers It S A Huge Waste Cbs Denver

Stimulus Check Update Irs Sends More Payments Social Security Ssi On The Way Nj Com

I Don T Care Who The Irs Sends I M Not Paying Taxes的youtube视频效果分析报告 Noxinfluencer

Irs Sends Out 1 8 Million More Covid Stimulus Payments Cpa Practice Advisor

/tax-documents-to-the-irs-3973948-v1-c43621daf8d548328ec95b4f53fd75ff.png)

How To Mail Your Taxes To The Irs

Half A Dozen Letters From The Irs Tpl

I Don T Care Who The Irs Sends I Am Not Paying Taxes Youtube

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

Irs Mistakenly Sends Stimulus Checks To Foreign Workers Politico

The Irs Audit Process Usaa

I Don T Care Who The Irs Sends I M Not Paying Taxes的youtube视频效果分析报告 Noxinfluencer

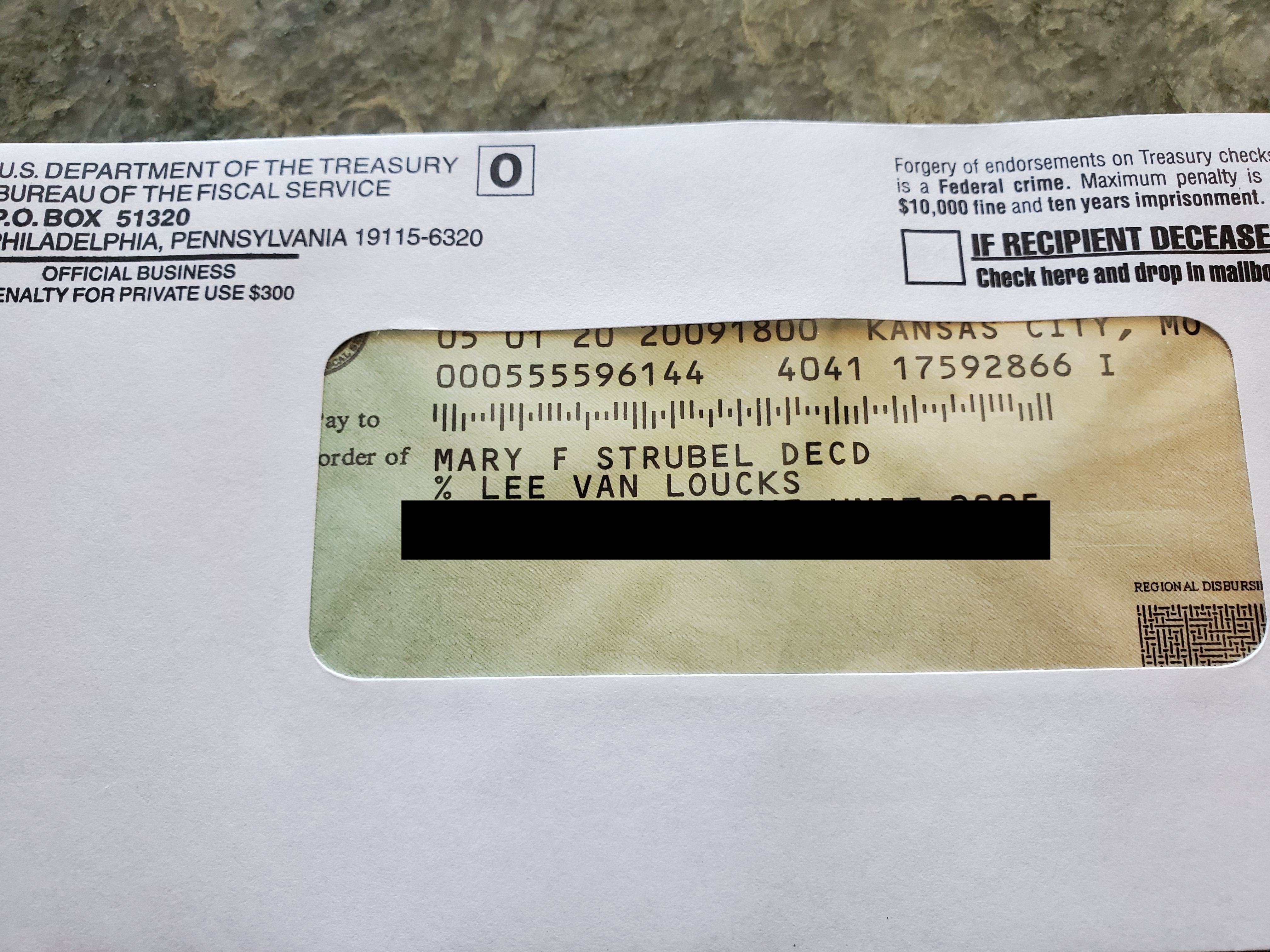

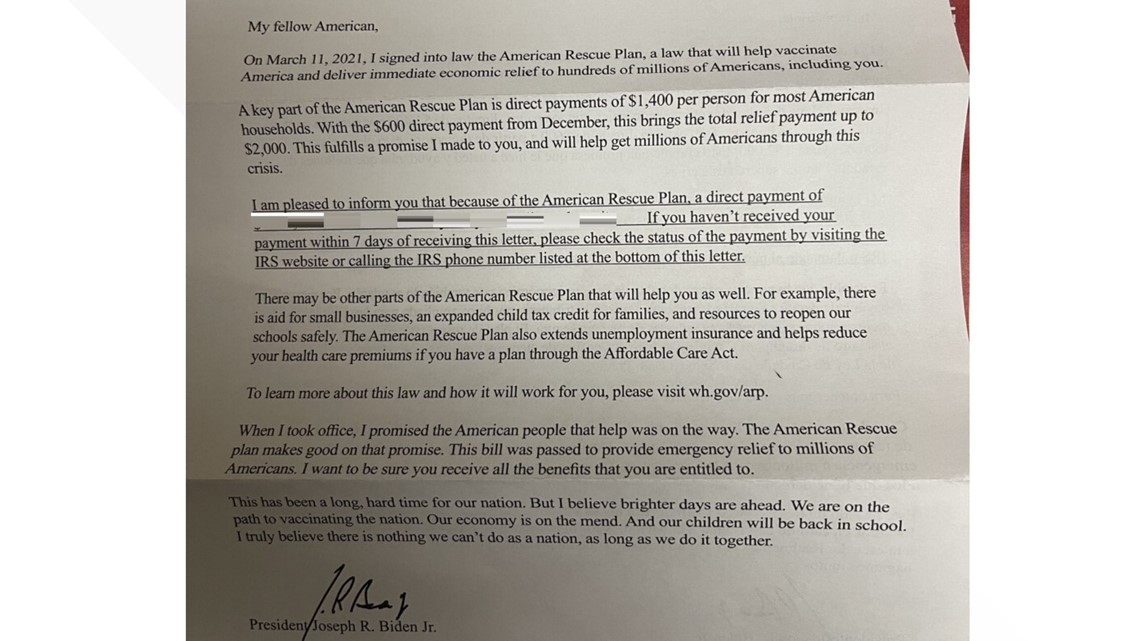

Stimulus Check Letter From President Biden Is Real Verifythis Com

Irs Sends Some 1 0 Checks For Coronavirus Pandemic Relief To Deceased People Npr

Why Is The Irs Sending Out Second Stimulus Payment Letters Wfmynews2 Com

Pseudofighting Tumblr Blog Tumgir

Ogden Irs Workers Called Back As Covid 19 Guidelines Ease Work Piles Up Government Standard Net

The Irs Is Making A Final Push To Get Stimulus Payments To Millions Of Americans The Washington Post

When The Stimulus Check In Your Bank Account Isn T What You Expected Wsj

Irs S Private Debt Collection Agencies Tax Defense Network

I Don T Care Who The Irs Sends I Am Not Paying My Taxes Youtube

Fire The Irs Chief Who Doesn T Care If The Rich Don T Pay

Irs Gives Taxpayers A Break On Repaying Extra Obamacare Tax Credits Accounting Today

Irs Sends Missing Stimulus Checks For Some Dependents

I Don T Care Who The Irs Sends I Am Not Paying Taxes Youtube

What The Irs Says About That Unemployment Stimulus Tax Break Los Angeles Times

Irs Sends Stimulus Checks To Dead People Leaving Loved Ones Wondering What To Do Abc7 Chicago

Irs Archives Page 2 Of 5 Irs Problem Solvers

When To Expect My Tax Refund Irs Tax Refund Calendar 21

I Don T Care Who The Irs Sends I Am Not Paying Taxes Youtube

Third Stimulus Check Update How To Track 1 400 Payment Status King5 Com

She S More Evil Than Joker Helltaker

Stimulus Check Update Irs Sends 2 Million More Payments Including Some For Veterans Nj Com

Tacks Evasion I Dont Care Who The Irs Sends Irs Meme On Me Me

How To Find Missing Stimulus Payments From The Irs

Irs Sends Out Final 1 400 Stimulus Checks Batch

Irs Tax Refunds On Unemployment Benefits Begin Hitting Accounts

I Don T Care Who The Irs Sends Funny

Some Will Receive Second Irs Tax Refund In May Cpa Practice Advisor

Dave Gardner What To Do With A Big Bill From The Irs

The I R S Sent A Letter To 3 9 Million People It Saved Some Of Their Lives The New York Times

I Don T Care Who The Irs Sends I Am Not Paying Taxes Youtube

I Don T Care Who The Irs Sends I Am Not Paying Taxes Days Of Future Past 293 On Ifunny

Karkat Homestuck Tumblr Posts Tumbral Com

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Stimulus Check 21 Irs Says Letter From White House Outlining Stimulus Payments Not A Scam Abc7 Chicago

8 Things To Know About An Irs Notice Taxact Blog

I Don T Care Who The Irs Sends I M Not Paying Taxes Genshin Impact

Dan Vs In 19 Seconds Youtube

Tabsg2wyhxo59m

Stimulus Check Update Irs Sends 2 3m More Payments Here S Who Is Getting Them Nj Com

0 件のコメント:

コメントを投稿